Trusted by Dental Teams at

Our Features

Endless paperwork, manual tracking of deadlines, and scrambling to update protocols every time there's a regulatory tweak – it's enough to make anyone's head spin. Plus, it eats into precious time that could be better spent making your patients smile.

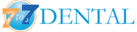

TRAINING & LMS

Integrated LMS allowing you to create or choose from a library of our pre-built training seamlessly.

Ensuring consistent training across multiple locations can be a challenge. With Done Desk's LMS, you can standardize training protocols, deliver engaging content, and track team progress.

Choose training topics from Done Desk's built-in training library - or create and upload your own training. Course Tracks allow you to build sequences of training — anything from a 30-day onboarding Track to a year-long CE Track. Get Training Done with Done Desk.

Your Office Documents

Centralized document hub - upload, organize, and sign documents.

With Done Desk Doc Automation, all your compliance documents – licenses, permits, policies – are neatly organized in one digital hub. Plus, with our SignableDocs feature — employees can sign required paperwork like W4s, I-9s, and more directly in-app!

Centralize document storage, enforce access controls, and maintain audit trails with ease. Rest assured that your organization is always prepared for inspections and audits, minimizing risk and safeguarding your reputation.

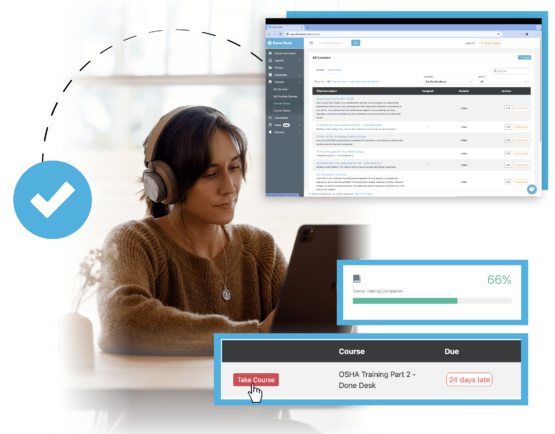

Tasks & Task Tracks

Create, assign, and monitor tasks across your organization.

Done Desk's pre-built library of Task Tracks get's you one step ahead — telling you what to do and how to do it! Then, keep track of things until it's time to do it again!

Create video Tasks and keep training employees continuously — or try out a repeating Task for things that need to get Done on a regular basis. If you can Task it — Done Desk helps get it Done.

Done Desk for DSOs

Track adherence across multi-locations and quickly identify areas of non-compliance. Standardize your practices.

Done Desk keeps a detailed log of all your compliance activities office-by-office.

Done Desk grows with your organization, adapting to your evolving needs and driving continuous improvement. Experience the Done Desk difference and unlock the full potential of your organization today.

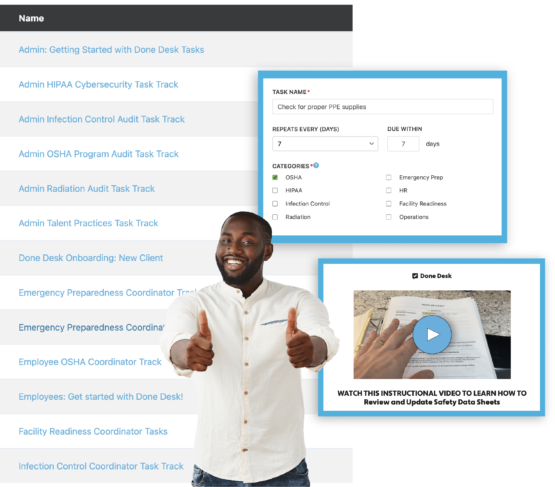

OSHA+HIPAA Built-In

Get the basics Done.

Get all your annual employee training Done with Done Desk! With our platform, you can ensure that your staff stays up-to-date and compliant with crucial regulations such as OSHA, HIPAA, and Continuing Education (CE) requirements.

Done Desk's LMS provides in-depth OSHA training modules covering topics such as infection control, hazardous materials handling, and emergency preparedness. With interactive content and real-world scenarios, our platform equips your team with the knowledge and skills they need to maintain a safe and healthy work environment.

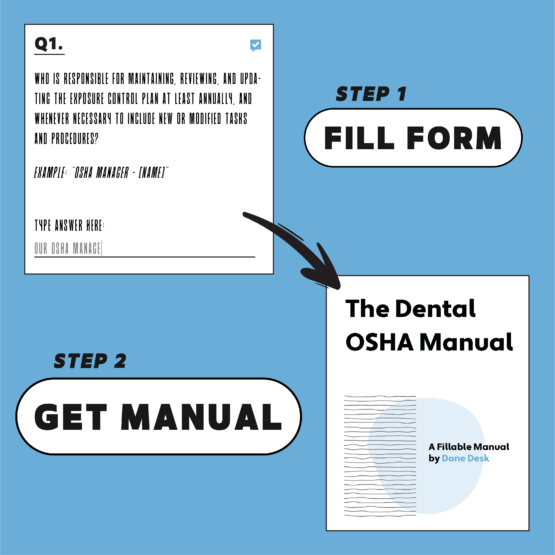

MANUAL BUILDER — FEATURE HIGHLIGHT

OSHA Manual Builder

Fill out our easy, self-guided OSHA Manual form with your practice’s info! We’ll guide you to collect the info you need. Get your filled, compliant Dental OSHA Manual delivered right to your inbox.

Congrats — you’ve got a Manual!

Get Even More Done with Done Desk

Risk Management

Compliance risk can pose a threat to your practice’s financial, organizational, and reputational standing — and in a world where regulation is only increasing and there’s a growing burden of reporting that must be taken care of — the ability to track compliance is key to keeping your practice in good standing.

Library of Document Templates

Along with our 300+ Practice Management document template library — you get Doc Tracks. Ensure each and every employee completes their required paperwork 100% and know your folks are in compliance at any given time.

Employee Testing

We're proud partners of AmeriWide — Background screening made easy! In today’s job market, we know there are time pressures in the hiring process. Talented candidates don’t last long. You don’t have the luxury of waiting a week for a background check. Our average turnaround time on a typical background check is 24 – 36 hours.

+ LIVE SUPPORT

Our team is at your fingertips for help and answers. Members can chat in for assistance from our expert team!

Demo Today & Experience the Power of Done Desk

Whether you're managing a small team or a large enterprise, Done Desk is the perfect solution for streamlining your Dental Practice Management. Join today for as low as $99/month!

HOW IT WORKS

Discover Done Desk Tasks

Use Cases

Employee Onboarding

Dr. Patel just hired 5 new staff members — she might have a few hours here and there, but certainly not enough time to train and onboard all these new folks... if only she had a way to set up automatic employee onboarding and training so she never had to worry about getting it done again.

Processes & Systems

Taylor just graduated Dental School and is opening their very first practice this year. (Congrats, Taylor!) They have nothing in place to build a strong foundation for their daily, weekly... or annual compliance and employee workflows. Taylor needs a platform that'll help them get all the basics done without being overwhelming, then grow along with their practice.

Dental OSHA Compliance

Nellie is a bright, young Office Manager — with a few years' experience under her belt, she knows her basics but what about all the components of OSHA besides annual employee training? She needs a system that can tell her WHAT to do, WHEN to do it, and HOW to get it done.

Hear from our awesome partners!

“I use Done Desk to take the guesswork out of running Brush 365’s multiple offices! As the office manager, the platform keeps us efficient with employee files, timekeeping, onboarding, and the array of compliance regulations. Done Desk allows me to focus my time on the most important part of my role… leading my people!

The value of this platform simply cannot be underestimated.”

— Michelle Akins

Director of Operations @ Brush 365

“I had literally been searching for something like Done Desk for over 5+ yrs.

One of the most impressive things about Done Desk is the team. I greatly appreciate using a product where the founder is open & appreciative of feedback. How rare is that? And the communication goes two ways – with my feedback, they let me know the direction of growth they are focused on. In addition, the Done Desk team is exceptionally responsive, often within minutes of questions I have and this makes all the difference in the world.”

— Dr. Jacqueline Demko

Demko Orthodontics

Dental CE, compliance, and training programs aren’t always easy to come by.

That’s why we made a centralized hub for all the training requirements that dental and medical professionals have to fulfill each year. Know you’re in great hands when you do your CE training with Done Desk EDU.

Got Questions?

We got answers. Hey, but if you want to save time — we can answer all your questions in a 15 minute demo!

Hi! Want to keep up with Done Desk? We’ll make sure to only send interesting info, no crappy content or fluff. Just the good stuff — promise!

Get In Touch:

info@donedesk.com

(512) 222-3812

Follow Us!

9am - 5pm CST | Mon-Fri

Chat with us in the lower right!

Done Desk™

Software proudly designed and handmade in the USA.

Headquartered in San Antonio, Texas.

100% Staffed by real people in the USA.

Done Desk EDU is an approved PACE Program Provider for FAGD/MAGD credit and AGD Approved Courses

Approval does not imply acceptance by any regulatory authority or AGD endorsement.

Provider ID# 389654 | 3/1/2023 to 2/28/2026

Copyright Done Desk™ 2024